Overview

This scam prevention guide on job listing scams helps you to recognise and avoid fraudulent employment opportunities online.

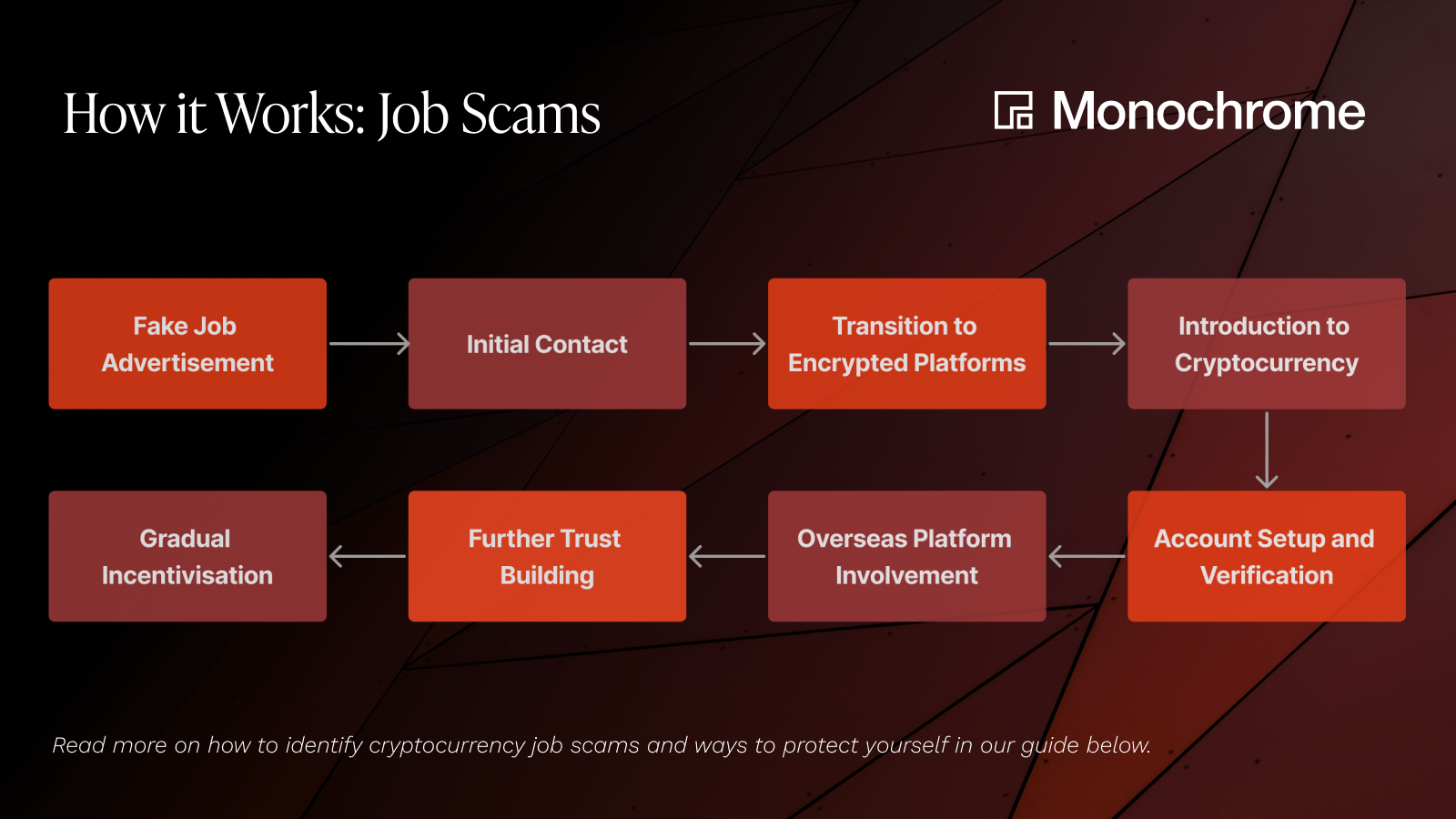

How It Works: Cryptocurrency Job and Employment Scams

Step 1: Fake Job Advertisement

- Scammer posts a fake job advertisement online.

- The fake job descriptions are made to look as convincing as possible, using publicly available information of the company it is impersonating, such as company name, ABN, office address, staff names and positions.

Step 2: Initial Contact

- Victim interacts with the job advertisement.

- A fake recruiter contacts the victim via email.

- The scammer's email address would look similar but slightly different from the email address of the company they are impersonating.

Step 3: Transition to Encrypted Platforms

- The fake recruiter directs the victim to communicate on encrypted messaging platforms (e.g., Skype, Signal, Telegram, WhatsApp).

- These messaging platforms may be set up with disappearing messages and the inability to take screenshots. This is to make it difficult for victims to collect evidence later on.

Step 4: Introduction to Cryptocurrency

- Victim is informed that as part of a 'job training process,' they need to demonstrate cryptocurrency trading or portfolio management skills.

- As part of this made-up 'job traning process', the victim is asked to use a specific trading platform nominated by the scammer.

Step 5: Account Setup and Verification

- The scammer provides instructions on opening an account with a local cryptocurrency trading platform.

- The scammer instructs the victim to complete the necessary verification process.

- Victim is directed to deposit funds and convert them into stablecoins such as USDT, a type of cryptocurrency.

Step 6: Overseas Platform Involvement

- Victim is instructed to send the cryptocurrency to an overseas platform controlled by the scammer.

- This platform remains secretive and controlled by the scammer.

Step 7: Further Trust Building

- The scammer gains the victim's trust by demonstrating that they can withdraw funds back into the local cryptocurrency trading platform.

- Victim is asked to withdraw their money back to their bank account, which further builds trust.

Step 8: Gradual Incentivisation

- The scammer gradually encourages the victim to transfer more money into the overseas platform as per Step 6.

- Victims are convinced, using high pressure tactics, that larger investments will yield bigger financial incentives.

- The scammer-controlled platform typically displays doctored paper gains, and demand fees for unlocking features/materials in the 'job training process.'

- At some stage, the victim would lose access to their funds and the scammer will become uncontactable.

Safeguards

There are some additional steps you may consider to prevent falling victim to cryptocurrency job and recruitment scams.

Be Informed About the Company

Conduct thorough research on the company offering the job opportunity. Verify the company's legitimacy by visiting their official website, checking for contact information, and be wary of misspelt website URLs, emails and/or company names.

Monochrome only operates the following domains:Cryptocurrency Trading Platforms are Unregulated in Australia

Unlike financial markets such as stock exchanges, cryptocurrency trading platforms are not regulated in Australia. All cryptocurrency trading platforms operate without an Australian Financial Services License (AFSL).

This means that anti-scam measures like fraud monitoring may not be as robust as regulated institutions. Adding to that, investor protection measures such as compensation and dispute resolution schemes do not exist on unregulated platforms.

Cryptocurrency trading platforms frequently give the impression of being regulated, even though they are not obligated to follow any AFSL regulatory guidelines. This has made them an attractive target for scammers to exploit.

Understand that an asset management firm like Monochrome, will never ask you to deposit funds into a cryptocurrency trading platform. If asked to do so, it is a scam.

Be Sceptical of Job Ads

Do not assume a job ad is genuine just because it is listed on a trusted platform or website. Scammers post fake ads too. If you suspect a scam, report it to the hosting platform or relevant authorities.

Protect Personal Information

Never send money or disclose personal information, credit card details, online banking, or cryptocurrency account details to anyone online, through email, or over the phone.

Beware of Small Payments

Scammers may provide small payments for completing tasks. Never send your own money, as you won't get it back.

Verify Contact Information

Ensure you are dealing with legitimate representatives. Contact recruitment agency representatives using phone numbers you have independently sourced online.

Avoid Hasty Decisions

Do not be pressured into making quick decisions. Legitimate job offers won't require immediate action. If an offer sounds too good to be true, it probably is.

Avoid Recruitment Referral Incentives

Refuse offers to receive payment or rewards for recruiting other people. Such offers are often part of scams.

Safeguard Personal Information on Resumes

Be cautious about including sensitive personal information like your physical address or date of birth in your resume. Share only necessary details.

Protect Identity Documents

Never send your passport or identity documents to an employer or recruitment firm unless you are certain they are genuine. Verify the legitimacy of the request and the organisation thoroughly.

By following these steps, individuals can take proactive measures to protect themselves from cryptocurrency job and recruitment scams and avoid becoming victims of fraudulent schemes.

Suspect you've been scammed?

If you suspect that you have fallen victim to a cryptocurrency job and recruitment scam or any other fraudulent activity, here are some steps to take:

Step 1: Cease Communication

Immediately stop all communication with the scammer. Do not respond to their messages or requests.

Step 2: Document Everything

Keep records of all communication, emails, messages, and transactions related to the scam. These records may be helpful when reporting the scam.

Step 3: Report the Scam

Report the scam to your local law enforcement agency, as well as to relevant regulatory authorities in your country. In Australia, you can report scams to the Australian Competition and Consumer Commission (ACCC) via the Scamwatch website.

Step 4: Inform Your Financial Institution

If you have shared financial information or made payments, contact your bank or financial institution immediately. They may be able to assist in limiting any potential financial losses.

Step 5: Strengthen Your Online Security

Change your passwords for online accounts to prevent further unauthorised access. Enable two-factor authentication where possible.

Step 6: Warn Others

Inform friends, family, and colleagues about your experience to prevent them from falling victim to similar scams. Sharing your story can help protect others.

Step 7: Seek Professional Advice

If you have suffered financial losses or have legal concerns, consider seeking advice from a legal professional or a financial advisor.

Remember that scammers are often skilled at manipulation and deception, so it's essential to take immediate action if you suspect you've been scammed. Timely reporting and documentation can increase the chances of apprehending scammers and recovering lost funds.

Note: The guides provide general information only and may be subject to change at any time without notice. It does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions.