Share

Learning Outcomes

In this session, you will learn the following introductory concepts:

- Brief history of mining equipment & technological innovation in the space

- Bitcoin’s energy mix and electricity use

- Future trends in the Bitcoin mining space

Introduction

This is the third instalment of Monochrome Research’s E in ESG series and will discuss the state of the Bitcoin Mining network. Topics to be explored in this report are the current state of mining hardware, and industry-wide electricity and energy use, and emissions.

Technological Innovation and State of Current Mining Technology

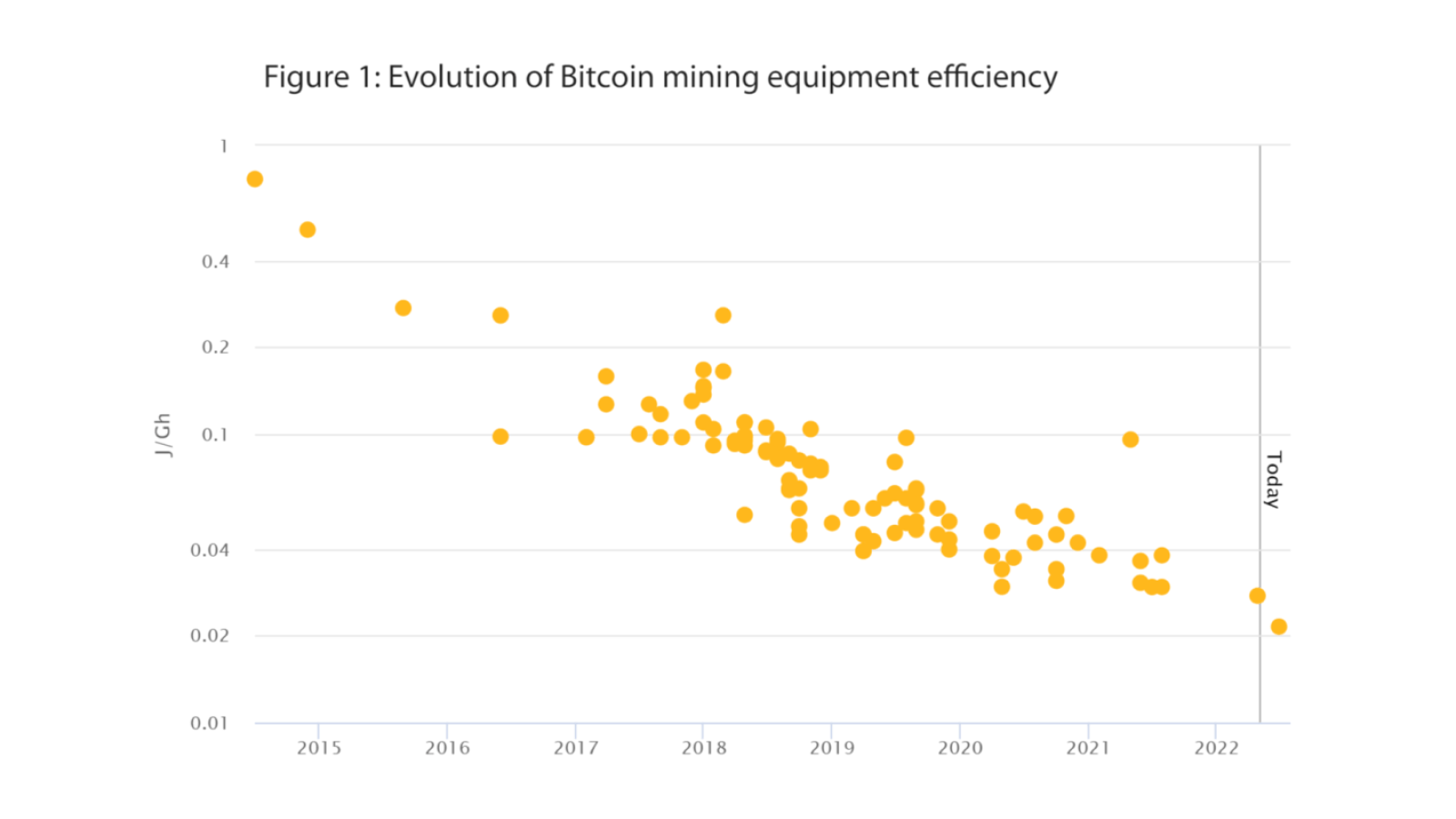

Ever since Application-Specific Integrated Circuits (ASICs) became the dominant computing force behind Bitcoin Mining in late 2013, improvements in hashing power per unit of energy have improved at a steady, yet dramatic pace. Figure 1 shows the evolution of Bitcoin mining equipment efficiency, measured in joules or watts per gigahash (W/GH).

Figure 1 - Evolution of Bitcoin Mining Equipment Efficiency (2014 - 2022)

Efficiency has improved from 0.77 W/GH in July 2014 (Bitmain Antminer S3) to 0.04 W/GH in June 2021 (Bitmain Antminer S19j), a reduction of almost 95%. As of this writing, the currently sold Bitmain Antminer S19 Pro has improved a further 26% to 0.0295 W/GH, with Bitmain's next model to be shipped in July 2022, the S19XP, boasting an additional improvement of 27% to 0.0215 W/GH. This consistent improvement, coupled with the profit motive, has driven exponential growth in network hash rate over the past 8 years. Although the ramifications of the global semiconductor shortage will impact procurement of new hardware in the short-to-medium term, it will not slow the pace of innovation.

Based on Cambridge and Coinshares estimates, the average miner on the network has an efficiency of between 0.06 J/GH and 0.07 J/GH, and could be expected to improve between 10-15% per year as new equipment is deployed and old equipment is retired.

Those miners not fabricating their own hardware can still innovate in areas such as datacentre cooling and configuration. Publicly listed Bitcoin miners, such as Riot Blockchain, are now investing in liquid immersion cooling to increase reliability, equipment lifetime, and reduce energy needed for cooling. Importantly, immersion allows miners to reduce capital expenditure per unit of hashing due to the ability to dramatically overclock the mining equipment safely. In terms of datacentre layout innovation, there are also publicly listed Bitcoin mining companies, such as Mawson Infrastructure Group, who deploy modularised or shipping-container-based solutions, which allows them to take their operations anywhere on Earth, land or sea, with a reliable power source and internet connection. We will revisit modularity and other innovations in Part 5 of the series - Bitcoin as a Driver of Energy Innovation.

Electricity Mix, Emissions and Carbon Intensity

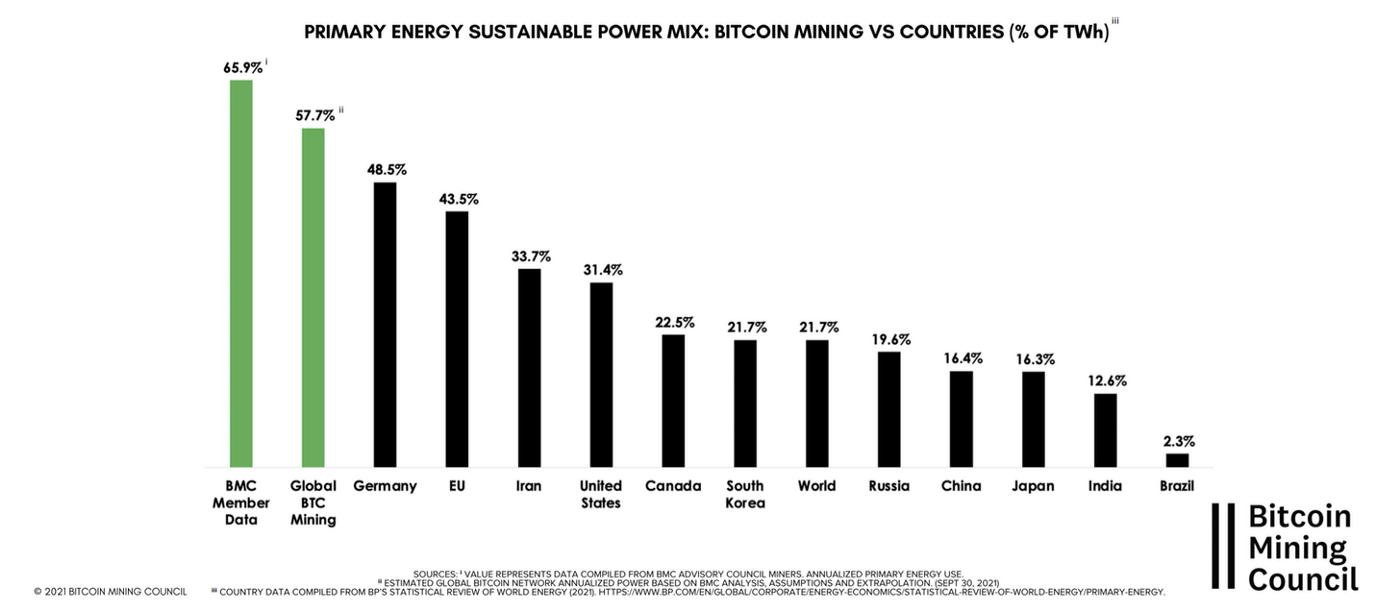

Whilst miners, especially privately held ones, may be reluctant to disclose specific details about their commercial agreements or composition of their mining rig fleet for commercial reasons, many miners have elected to voluntarily self-report their energy mixes. Formed in 2021, the Bitcoin Mining Council represents 33% of the network hashrate, and provides quarterly updates on sustainable power mix. Based on data collected post-China migration in 2021, and shown in Figure 2, the membership of the Bitcoin Mining Council drew its power from 65.9% sustainable, low-emissions sources, with an estimate that 57.7% of the entire network is powered by low-carbon, sustainable sources (renewables + nuclear and hydroelectric). In contrast, the world average energy mix is only 21.7% sustainable, The USA at 31.4%, and the EU at 43.5%.

Fig. 2. Bitcoin Sustainable Energy Mix 2021. Sustainable sources include Renewables, Hydroelectric and Nuclear Energy.

In research by the Cambridge University Centre for Alternative Finance (CCAF) in late 2020, prior to the Chinese ban on Bitcoin mining, it was estimated that up to 49% of Bitcoin was powered by sustainable sources (10% Nuclear, 28% Hydroelectric, 11% Wind, Solar and other renewables). That same report found that 65% of Chinese miners used coal as their energy source. Therefore, a positive jump from 49% sustainable to 57.7% post-migration is to be expected.

In terms of emissions, the 49%-sustainable CCAF scenario resulted in 418.5 grams of greenhouse gases per kilowatt-hour of energy (skewed quite dramatically by coal use in China). Post-migration, in the 57.7%-sustainable BMC scenario, the carbon intensity dropped by almost a third to 280g CO2eq/kWh. Whilst quite dramatic, the China migration meant that a huge portion of the network was no longer powered by high percentile emitting coal, but far cleaner natural gas and renewable sources.

Electricity and Energy use

Once a few fundamental variables are identified and understood, calculating electricity use is trivial to determine. Electricity use is simply the product of the network hash rate (measured in hashes per second) and the average network efficiency (measured in watts per hash) resulting in an electricity draw, measured in watts, or more appropriately for Bitcoin, Gigawatts. As of May 21, 2022, The 14-day average hash rate was 218 x 19^18 hashes per second (or 218 EH/s) multiplied by an assumed rig efficiency of 0.07 W/GH results in a draw of 15.3 GW of electricity. To find equivalent yearly electricity consumption, the draw (15.3GW) is multiplied by 365 days multiplied by 24 hours, which results in 133.8 TWh consumed per year. It should be noted that since hash rate is highly variable, point-in-time power draw is a far more relevant and descriptive metric than a yearly extrapolation.

In global terms, this is roughly equivalent to 0.5% of the world’s electricity demand.

It is important to note that electricity use and energy use are two distinct metrics. All electricity starts off as primary energy (i.e. sunlight, wind, coal, oil, etc). This will be discussed in further detail in Part 4 of this series but In short, Bitcoin’s electricity mix converts roughly 54% of primary energy into electricity. This makes Bitcoin’s 133.8 TWh/year electricity consumption equivalent to 252.5 TWh/year of primary energy, or roughly equivalent to 0.08% of the World’s energy consumption.

Future Trends & Expectations

Whilst it is impossible to foretell the future, knowing that the nature of competition in Bitcoin mining is near-perfect, and becoming increasingly perfect with time, logical conclusions can be made. Effectively, Bitcoin miners mine bitcoin when the cost to mine is cheaper than market price, or when mining is the only means available to acquire bitcoin. When the gap between cost and price is large, fierce competition and innovation closes the gap. When cost and price are similar, as in extended bear markets, only the most efficient miners survive to see better days. One thing is for certain, as Bitcoin’s price climbs, more energy will be spent in the pursuit of its acquisition. For example, if a speculative bubble sent the bitcoin price to $1 million, with a cost to mine of, say, only $50,000 (i.e. $950,000 profit per mined bitcoin), competition for securing scarce hardware to mine may be so fierce and drive prices so high, that traditional firms like Intel may opt to profit by providing hardware to Bitcoin miners to capture the high premium. Indeed, as of April 2022, Intel is now a player in the ASICs manufacturing game, partnering up with soon to be publicly-listed miner GRIID, who will purchase 25% of Intel's manufacturing output.

In line with the principles of perfect competition discussed in Part 2 of this series, we should expect strong competition, and importantly, horizontal and vertical integration to the point where there are three to four players dominating 80% of the Bitcoin mining space.,, A fully integrated Bitcoin mining company would provide their own power and hosting sites, as well as design, fabricate, mine with, and sell their own mining hardware. With 20-year long agreements currently being formed between large US-based miners and utilities, tighter integration is the natural next step. Finally, in addition to the handful of public miners today, many more miners will likely go public in order to scale and gain access to capital markets.

Carbon Intensity and Emissions

The International Energy Agency (IEA) has a Sustainable Design Scenario (SDS) which sets out energy and emissions goals from 2020 to 2050. The United Nations also has 17 Sustainable Development Goals (SDGs) calling for dramatic decarbonisation of world grids. As Bitcoin generally relies upon “the grid”, general decarbonisation efforts will positively improve Bitcoin’s carbon intensity profile. However, due to the economic incentives on offer for mining with wasted and stranded energy and acting as a controllable load to increase profitability for utility providers, Bitcoin should improve at a far faster pace than the world grid.

Energy Use

As long as a gap exists between mining cost and bitcoin price, more energy will be dedicated to mining bitcoin. Theoretically, there is no bound to how much energy the Bitcoin network could use. Practically however, there are only so many application-specific Bitcoin mining chips that can be manufactured. Depending on the price of bitcoin and the amount of profit on offer, a distant future where power plants are built by investors for the single purpose of mining bitcoin could be imagined.

Technological Innovation and Constraints

Although physical production can be hampered by chip shortages and supply chain difficulties, it is difficult to hamper the human mind and entrepreneurial spirit. Thus, even though chips aren’t currently being shipped as frequently, or in as large a quantity, improvement and innovation is not slowing down. The main quantifier of innovation is chip transistor density, denominated in nanometers (nm) - the smaller the process size or “architecture”, the higher the transistor density, and thus, the efficiency. The Antminer S9, released in 2018 had 16 nanometer (nm) architecture, the S17 and S19 in 2017 and 2019, respectively, had 7nm architecture, and the upcoming S19XP will be 5nm. The world’s largest semiconductor company, TSMC, will be releasing 3nm and 2nm processes in 2023 and 2025 respectively. It can be expected that the efficiency gains of 25-30% between architecture generations will continue for the remainder of the decade, with commodification of mining equipment to happen near decade’s end.

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Related Articles

How to Value Bitcoin (2024 Update)

Valuing Bitcoin can be a challenge as, due to its abstract nature, there is “nothing to relate it to.” However, by shifting the lens through which we view Bitcoin, we can arrive at compelling theories through Metcalfe’s law, Stock-to-Flow, cost of production, market sizing and relating it to a technology start-up. Taken together, the following valuation models can be useful, though individually insufficient. Each model hosts criticisms, accommodating for improvements and adaptations.