Share

Learning Outcomes

In this session, you will learn how to navigate the different ways you and your clients can gain exposure to Bitcoin, specifically:

- The several ways to gain exposure to Bitcoin.

- Key insights into the advantages and disadvantages of each pathway.

- The importance of secure storage and the risks associated with self-custody.

- The expectation of spot Bitcoin exchange traded funds (ETFs) becoming available in traditional financial markets and regulatory changes.

Foreword

The growing popularity and adoption of Bitcoin as an asset class is leading many to consider an allocation of bitcoin within their portfolios and self-managed super funds. A survey by New York Digital Investment Group revealed that “62% of clients would switch financial advisors to one that offers advice about Bitcoin”, but that “only 3.5% of advisory clients hold bitcoin with their advisor”. These statistics illustrate the need for advisers to consider the inclusion of bitcoin within client portfolios.

Of course, different types of investors will have different risk profiles and levels of sophistication when it comes to acquiring bitcoin, and here we explore the various pathways to bitcoin exposure, while highlighting the benefits and risks of each.

Digital Currency Exchanges

Digital currency exchanges (DCEs) use an order book to match buyers and sellers, with sellers posting an “ask” price and buyers posting a “bid” price. When a bid and ask price overlaps, the DCE executes the trade on behalf of the parties. To buy bitcoin on a DCE, investors have to open an account with the DCE, fund it and then buy their bitcoin.

The problem with buying bitcoin on DCEs is that they are mainly unregulated. If anything goes wrong with the purchase of bitcoin on the DCE, or if the DCE goes into liquidation holding that bitcoin, the rights of investors become unclear. Investors that buy bitcoin on a DCE and store it there should note there is currently no legal obligation for DCEs to hold that bitcoin on trust and many DCEs include terms and conditions which state that legal title does not pass to the investor while they keep their bitcoin on the exchange. If the DCE goes into liquidation, investors may find their rights to their bitcoin are limited as unsecured creditors.

DCEs also keep large amounts of clients’ crypto assets in digital hot wallets to provide trading liquidity, which in turn attracts potential hackers trying to access those assets. Further, DCEs without adequate internal controls run the risk of a theft of client assets by employees who exploit these weaknesses for their illicit gains. One report suggests that between 2011 and 2021, there have been at least 52 incidents of DCE hacks or internal theft by DCE employees resulting in a total of USD$2.1 billion in lost crypto assets.

Thus, while buying and storing bitcoin on DCEs may be an easy pathway to bitcoin exposure, there are significant risks in doing so, particularly when investors store their bitcoin on the exchange.

Over the Counter Desks (OTC)

Over the Counter Desks (OTC Desks) tend to mainly service the institutional market and unlike DCEs, they set their own bitcoin price, although generally speaking it tends to reflect the prevailing spot price. OTC Desks charge a spread to cover their costs and fees in sourcing and selling their bitcoin, and they predominantly service their clients in two ways: they either trade bitcoin which they hold directly on their own balance sheets, or they execute orders on behalf of customers and source liquidity for their orders from other OTC Desks or DCEs.

However, OTC Desks tend to only service larger trades and are generally not prepared to engage with smaller retail traders. They also generally do not offer custody as part of the sale contract which means investors need to have a custody solution in place when they purchase bitcoin from an OTC Desk.

Derivatives

Another pathway to bitcoin exposure is through derivatives, such as options, futures or perpetual swaps. Although each provides slightly different rights, they essentially allow investors to speculate or hedge on the future price of bitcoin without having to own the asset. This allows investors to gain exposure to bitcoin without having the responsibility of custodying the asset - at least while they do not exercise their rights under the derivatives contract.

While this may seem an attractive option for exposure to bitcoin, investors pay a premium for derivatives which is often linked to the price of the underlying asset. Given the highly volatile nature of bitcoin, a failure to maintain their margin can result in a close out of positions and a loss of the premium paid by investors.

Active exposure through proxies involved in the bitcoin ecosystem

Investing in entities which either hold bitcoin on their balance sheets or which invest in companies or trusts involved in the bitcoin ecosystem (e.g. an active strategy targeting bitcoin miners) allows investors to gain indirect exposure to bitcoin. This exposure can occur through regulated pathways such as retail managed funds or listed companies making it an available strategy for retail investors.

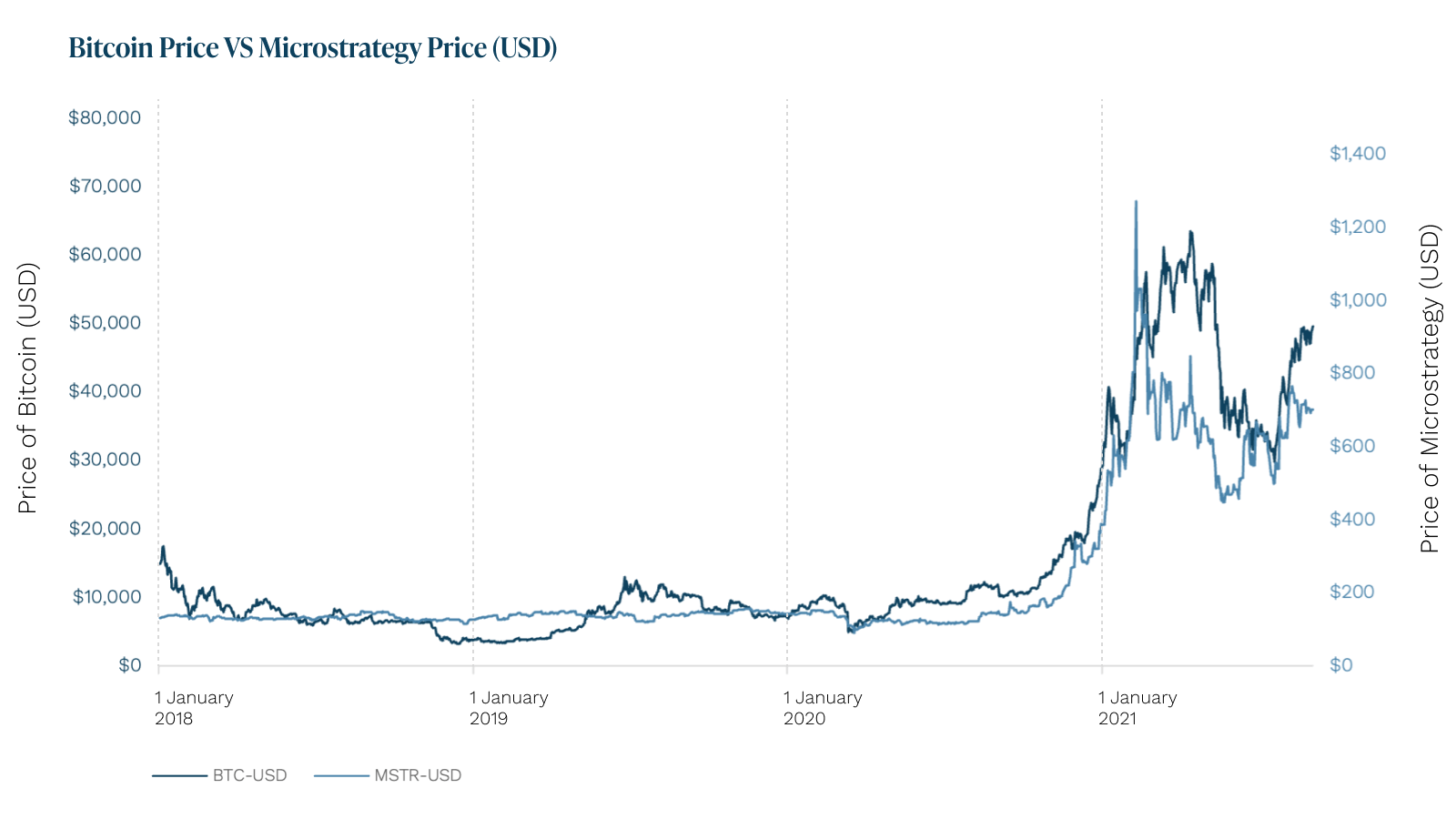

An example of this is MicroStrategy Incorporated, an American company that provides business intelligence, mobile software, and cloud-based services. MicroStrategy has famously maintained a large amount of bitcoin on its treasury balance sheet. As shown in Figure 1, MicroStrategy’s returns have closely tracked bitcoin’s, making its shares a good Bitcoin proxy. However, this type of strategy carries significant risks which are common in traditional equity asset classes, where changes in management, strategy and/or market conditions may lead to returns which become uncorrelated to the asset investors are seeking to track.

Passive exchange traded products

Exchange traded products (ETPs) are listed on licensed markets (e.g. on Cboe, the ASX, etc.) and interests in ETPs are traded through brokers (e.g. through a Commsec or NabTrade account). ETPs are retail products and thus offer a highly regulated solution for exposure to the underlying asset. Passive ETPs holding bitcoin are a good way for investors to gain exposure to bitcoin because they provide investors with all of the consumer protections afforded for retail financial products, including professional custody solutions, whilst tracking the price of bitcoin on either a daily or intra day basis.

The Monochrome Bitcoin ETF (Ticker: IBTC) is an example of an ETP passively holding BTC and is the first ETP in Australia to hold bitcoin directly through a specific crypto asset authorisation.

By purchasing units in an ETF, the investor outsources many of the risks associated with direct bitcoin holdings, such as custody, key storage and management, to professionals and in return, investors pay a management fee to cover those services.

Other pathways to bitcoin exposure

Other pathways to bitcoin exposure include bitcoin mining, earning bitcoin and Bitcoin ATMs.

Bitcoin mining is as technically difficult to undertake as it is to describe. Although turnkey solutions now exist to allow tech-savvy entrepreneurs to start a sustainable and profitable mine for a few hundred thousand dollars, the harshly competitive nature of the Bitcoin mining industry means that only the best miners survive the “Bitcoin Rollercoaster”. Mining is not suitable for investors looking for passive exposure to Bitcoin. One might instead invest in one of the several publicly traded Bitcoin miners as a proxy to mining themselves.

Earning bitcoin is another pathway where entities or individuals choose to be paid in bitcoin. This can be your wage, selling an item, or even earning bitcoin rewards when using your credit card. It simply means getting paid in bitcoin for a product or service.

Finally, despite fees of up to 15%, Bitcoin ATMs provide a convenient, fast and familiar experience to trade bitcoin. Similar to a regular ATM, this method is designed for small, everyday transactions and is not suitable for large purchases of Bitcoin. Bitcoin ATMs remain a small market.

Conclusion

As financial planners increasingly turn their attention to bitcoin as a legitimate asset to hold in client portfolios, they need to consider the best way to gain that exposure in a transparent and regulated way within their existing business models. Each of the above pathways have strengths and weaknesses. A common issue amongst the outlined investment vehicles is security, where most pathways to purchase bitcoin require taking custody of the bitcoin or otherwise relinquishing legal title to the asset (as is the case with storing crypto on most DCEs). Managing digital wallets can be a hindrance to many investors, due to the risks inherent in managing and storing private keys. A viable alternative they may wish to consider is ETPs with a passive exposure to bitcoin as they provide a familiar and regulated investment vehicle which can be easily added to existing portfolios within planners’ existing business models.

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Related Articles

How to Value Bitcoin (2024 Update)

Valuing Bitcoin can be a challenge as, due to its abstract nature, there is “nothing to relate it to.” However, by shifting the lens through which we view Bitcoin, we can arrive at compelling theories through Metcalfe’s law, Stock-to-Flow, cost of production, market sizing and relating it to a technology start-up. Taken together, the following valuation models can be useful, though individually insufficient. Each model hosts criticisms, accommodating for improvements and adaptations.

ESG Series - Governance Part 2: How Poor Governance Leads to Poor Outcomes

Since Bitcoin’s inception in 2008, the interest in Bitcoin and other digital currencies has grown significantly. Between 2010 which saw the very first exchange created which made it simpler to trade bitcoin, to the now arguably saturated marketplace for cryptocurrency exchanges, inadequate governance at cryptocurrency exchanges and other centralised crypto institutions has manifested in poor consumer outcomes.