Share

FTX: A November Update

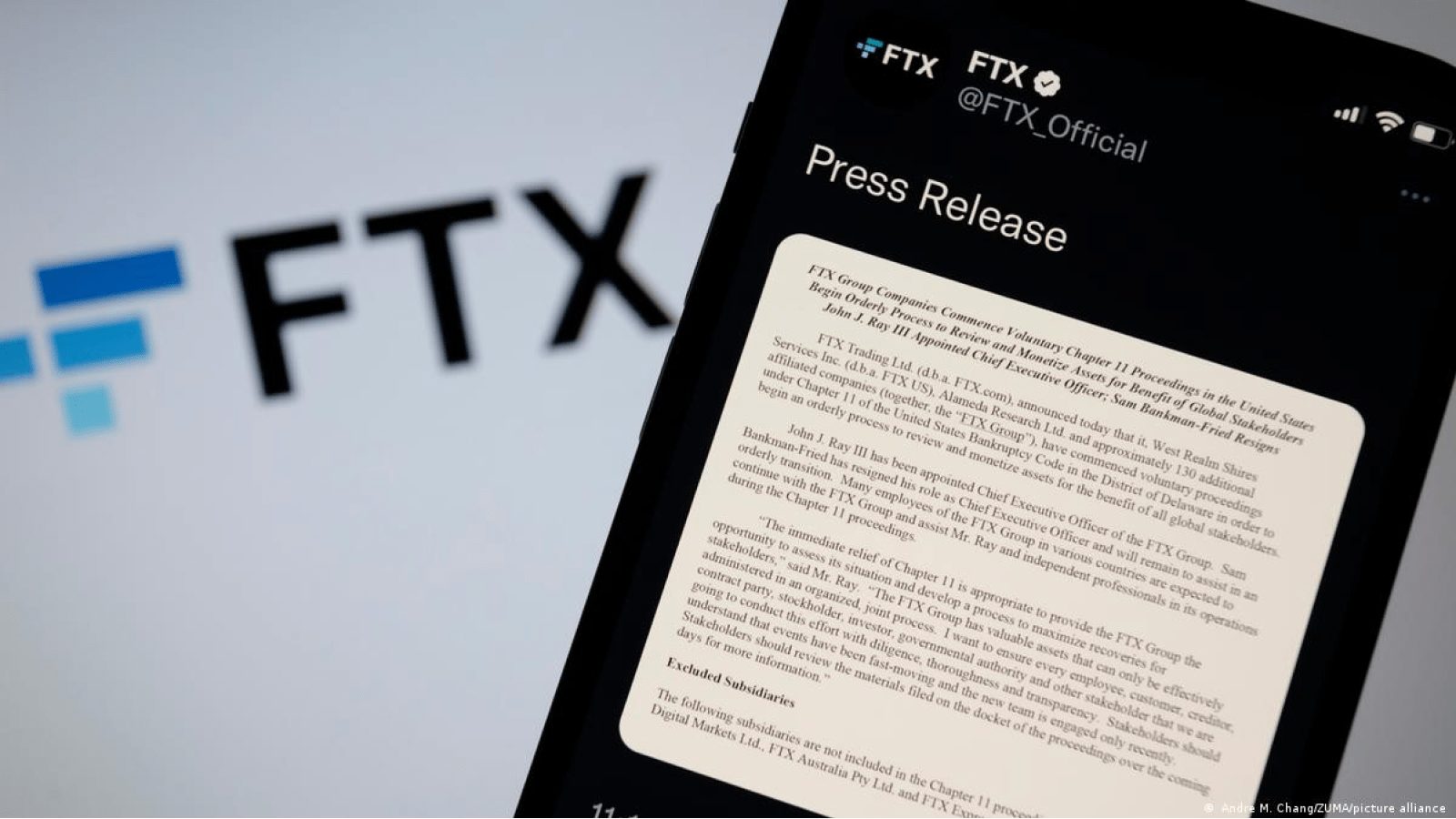

On 16 November, newly released audio was released of an interview held between Sam Bankman-Fried, the Founder and CEO of embattled cryptocurrency exchange FTX, and Tiffany Fong, a crypto investor-turned-whistleblower. This interview was important because questions continue to be asked regarding how FTX and its sister company, Alameda Research, collapsed which caused fund withdrawals to be paused.

There were several key insights that could be drawn from this interview. Firstly, regarding how FTX and Alameda Research misappropriated billions of dollars worth of user funds, Bankman-Fried continued to blame mistakes made regarding not realising how heavily the firms were levered and accounting errors. However, Bankman-Fried has since received criticism that these explanations are unsatisfactory, considering the scale of funds that were misappropriated. Secondly, Bankman-Fried provided some insight regarding why he reopened fund withdrawals for a short period of time for residents of the Bahamas. According to Bankman-Fried, the reasoning for this was that it was “critical to the exchange being able to have a future." He continued to explain that “this was us trying to create a regulatory pathway forward for the exchange just to appease the citizens of the country that we’re currently in.” In response to a question regarding whether Bankman-Fried himself created a “back-door” to move customer funds from FTX to Alameda Research, Bankman-Fried rejected the notion, claiming that "I don't even know how to code", which contradicts his previous high level market-making role at Jane Street. However, this still leaves the possibility of someone else within FTX or Alameda Research being responsible for creating a “back-door”.

On 29 November, Bankman-Fried was called to a February 2 hearing with the Texas State Securities Board regarding a securities violations claim that FTX US offered unregistered securities products through its yield-bearing service. The investigation became public in October, following a claim by Director of Enforcement Joe Rotunda in the Voyager Digital bankruptcy case that FTX US may have been violating securities offerings laws by offering yield-bearing products to US customers. The Texas State Securities Board is seeking a cease-and-desist order to stop securities fraud in Texas, and return money to investors.

HASH RATE UPDATE: Bitcoin Hash Rate Hits All-Time High in November

In November, Bitcoin set an all-time high record for hash rate. The new hash rate all-time high is 331 EH/s (exahashes per second), and this all-time high was achieved on 2 November.

This news is significant for multiple reasons. From a Bitcoin network perspective, a new hash rate all-time high suggests that the network is extremely healthy due to the large presence of miners. This would also suggest that large amounts of capital flows have been made into the space, considering that capital costs for mining operations are a large expense. Furthermore, an increased hash rate is beneficial from a network security perspective, since an increase in network hash rate implies that the possibility of a 51% attack has effectively decreased.

On the other hand, an all-time high in hash rate shows that the Bitcoin mining market is becoming increasingly competitive amid recently poor financial performance from Bitcoin. As a result, margins on Bitcoin mining would likely have decreased. It is speculated that if the network hash rate continues to increase without a corresponding increase in price, a capitulation could occur where Bitcoin miners sell their Bitcoin to pay off costs of capital.

Regardless of the current fallout from the FTX collapse and knock on effect to other centralised crypto players, the Bitcoin network continues to grow stronger and healthier than ever.

BITCOIN PROTOCOL UPDATE: Has The Bitcoin Network Been Affected by Recent News?

Over the month of November, the developments regarding the collapse of FTX and Alameda Research have rocked the financial performance of Bitcoin and crypto more generally, with bitcoin and ether falling by approximately 16% and 23% over the month of November.

However, do these negative financial results indicate a problem with Bitcoin? Not at all. These results are simply due to a “contagion” effect that occurs when an adverse event occurs in the crypto-asset space. Some investors, when they observe businesses in the crypto-asset space fall into financial distress, may react by selling down their crypto-assets. However, investors need to differentiate between poor actors in the space, and the actual asset itself.

Therefore, while the price of Bitcoin has indeed been adversely affected by the developments with FTX over the month of November, the Bitcoin network itself continues to operate smoothly.

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Monochrome Asset Management

Related Articles

Monochrome Partners with Galaxy Digital for Total Bitcoin Wealth Management

Monochrome Capital, a related entity of the investment manager of the Monochrome Bitcoin ETF (IBTC), today announced a strategic partnership with Galaxy Digital to deliver comprehensive Bitcoin wealth management solutions for institutional clients.

IBTC Integrated into Bitcoin-Backed Mortgages for Qualifying High-Net-Worth Investors

The Monochrome Bitcoin ETF (IBTC) has been incorporated into a Top 4 Australian bank’s residential mortgage lending framework. IBTC is now recognised alongside traditional assets such as unencumbered property and income streams when assessing high-net-worth (HNW) investors for home loans. This development connects regulated Bitcoin ETFs with private banking services, enabling Bitcoin holders to access property financing without liquidating their exposure.