Share

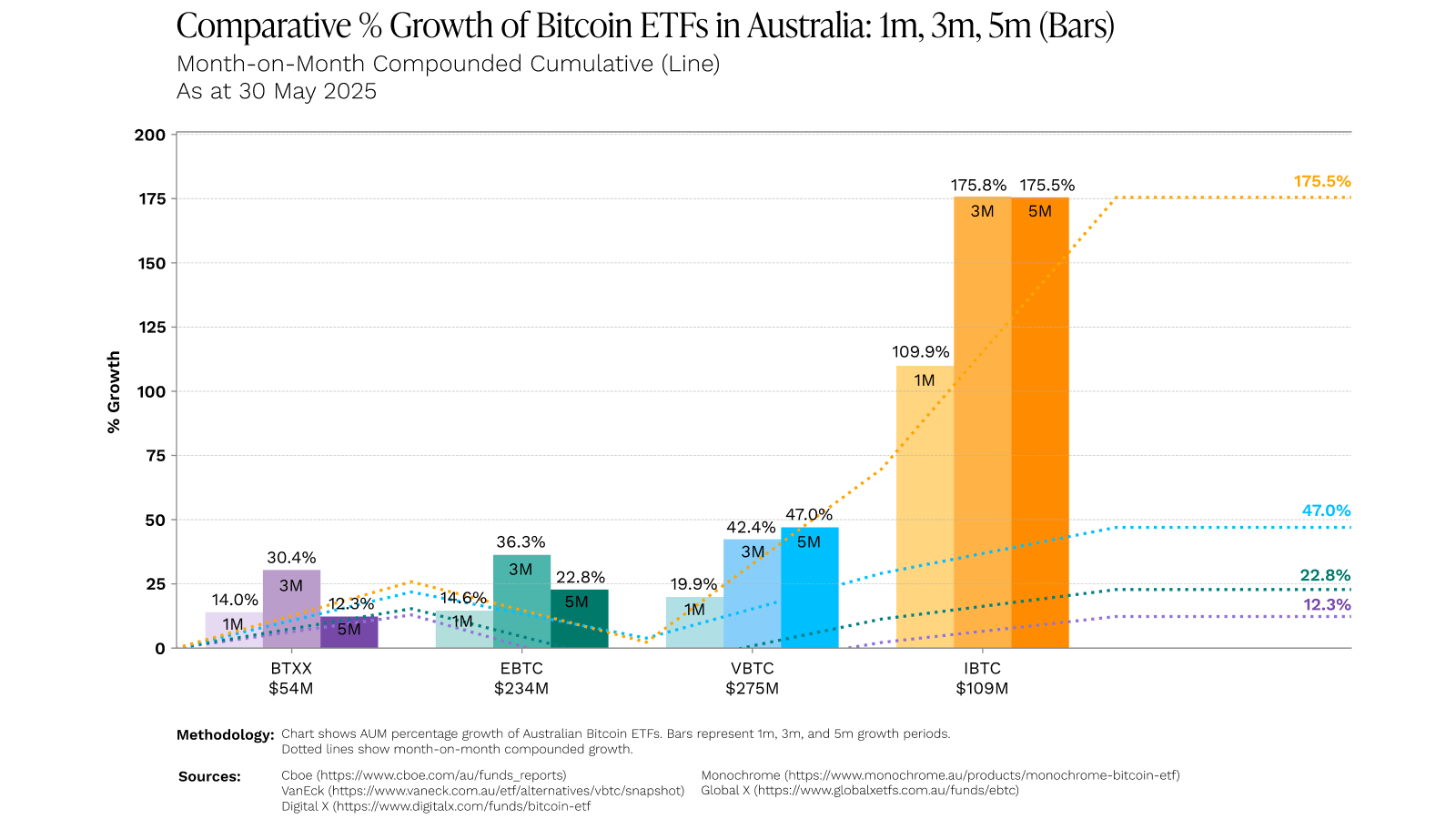

SYDNEY, 6 June, 2025 – In May 2025, the Monochrome Bitcoin ETF (IBTC) was the fastest growing Bitcoin ETF in Australia,1 as measured against its four Australian peers over the same period, a milestone that reflects both growing investor confidence in the Monochrome group and the strength of the ETF’s design.

IBTC is the only Australian-listed Bitcoin ETF offering two-way in-kind transfers, enabling eligible investors to bring existing Bitcoin holdings directly into a regulated ETF.

As the chart below shows, IBTC has rapidly outpaced other Bitcoin ETFs in AUM growth, a signal that the market is recognising the difference.

Figure 1: Australian Bitcoin ETFs Comparative % Growth Bar Chart (1m, 3m, 5m) Data as of 30/05/25.

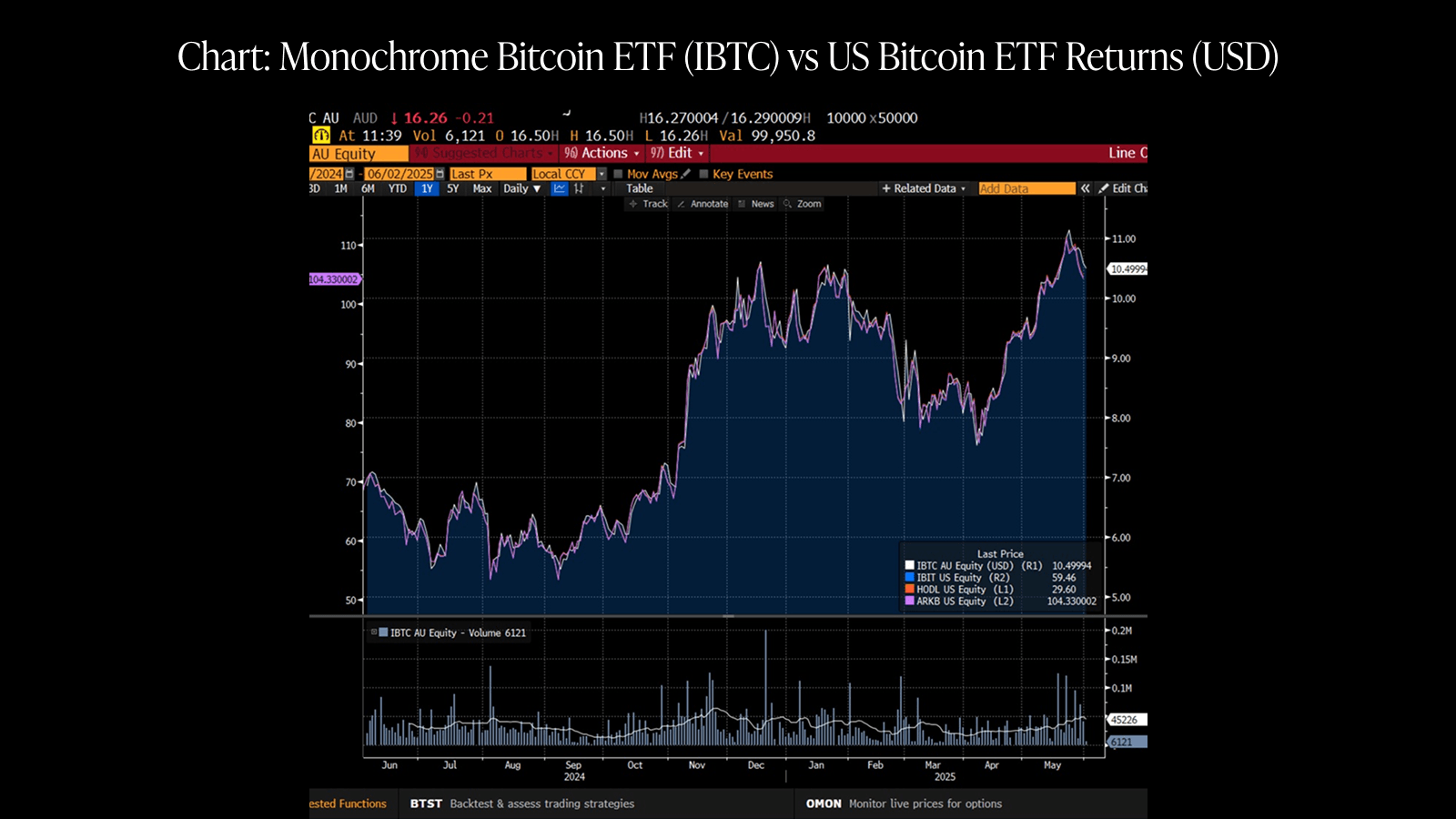

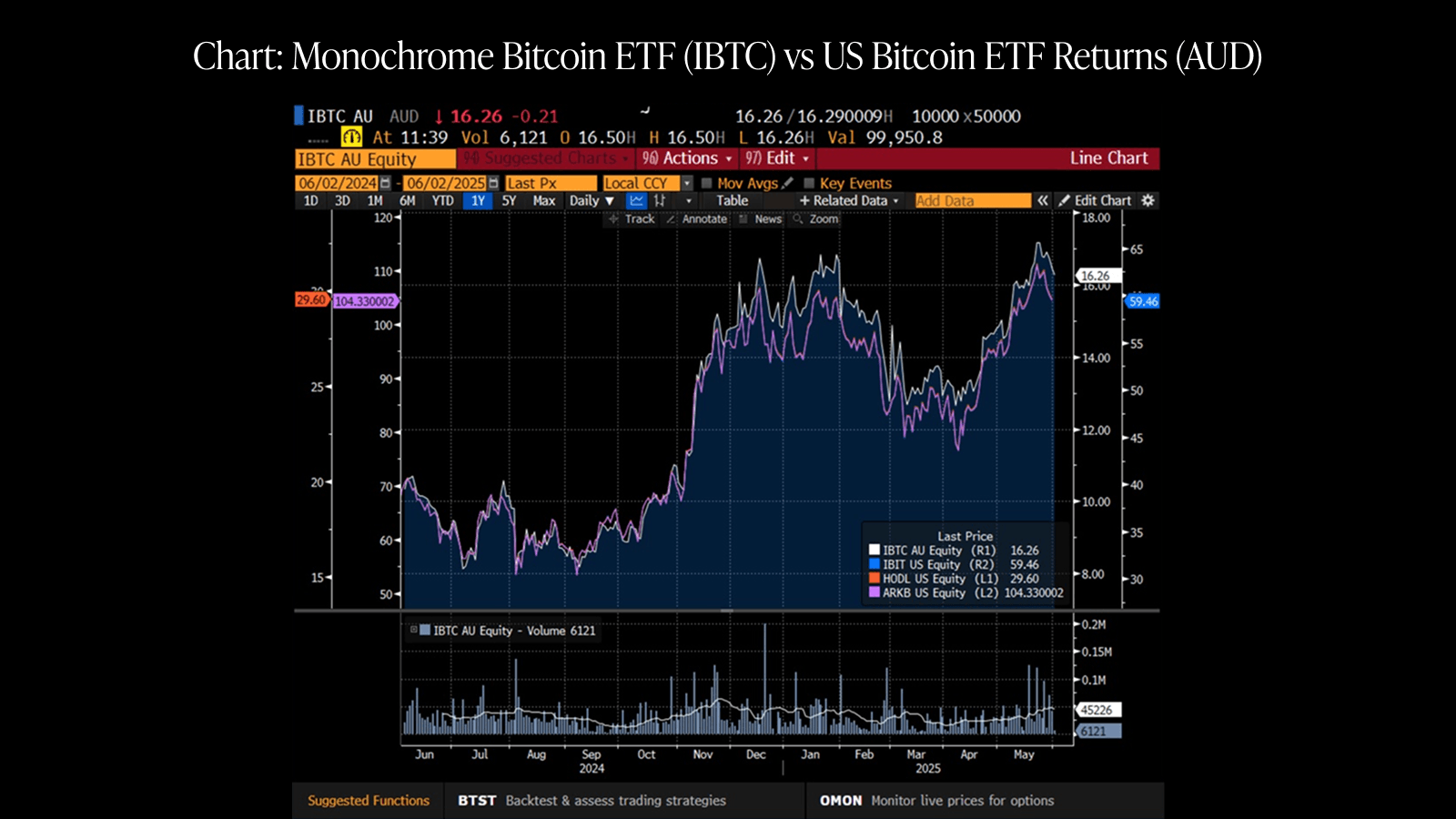

IBTC’s integrity has been consistently demonstrated through its total returns performance, and supported by its low cost structure.

Figure 2: Monochrome Bitcoin ETF (IBTC) vs US Bitcoin ETF Returns Chart (USD), data as of 30 May 2025.

Figure 3: Monochrome Bitcoin ETF (IBTC) vs US Bitcoin ETF Returns Chart (AUD), data as of 30 May 2025.

1 As measured over the period 31st December 2024 to 30th May 2025, on a compounded percentage AUM growth basis. The data incorporates 5 month, 3 month and 1 month look-back periods. ETFs not listed in Australia for 6 months or more were excluded.

Monochrome Asset Management

Related Articles

Monochrome Partners with Galaxy Digital for Total Bitcoin Wealth Management

Monochrome Capital, a related entity of the investment manager of the Monochrome Bitcoin ETF (IBTC), today announced a strategic partnership with Galaxy Digital to deliver comprehensive Bitcoin wealth management solutions for institutional clients.