Share

Bitcoin ETFs have exploded onto the Australian market, giving investors a regulated way to gain exposure to the world's largest cryptocurrency, without the hassle of digital wallets or security keys. But with six Australian Bitcoin ETFs now competing for your investment dollars, how do you choose one?

Not all Bitcoin ETFs are created equal. While they all track the same underlying asset, the differences in Management Fees, Total Return performance, and tracking efficiency can cost (or save) investors thousands over the long term.

This guide cuts through the noise to show you exactly what to look for across four key metrics that separate each one from the rest. A trophy symbol (🏆) is awarded to the Bitcoin ETF in each category that has the best metric for investors.

1. Management Fees

Management Fees eat directly into investor returns, and over time, even small differences compound into surprisingly large amounts. Selecting a Bitcoin ETF with competitive Management Fees is one key thing investors can do to seek to maximise their returns.

The Management Fees of all Australian Bitcoin ETFs are displayed below (from lowest to highest):

(1) Management Fees as published by the Issuer as at 27 January 2026.

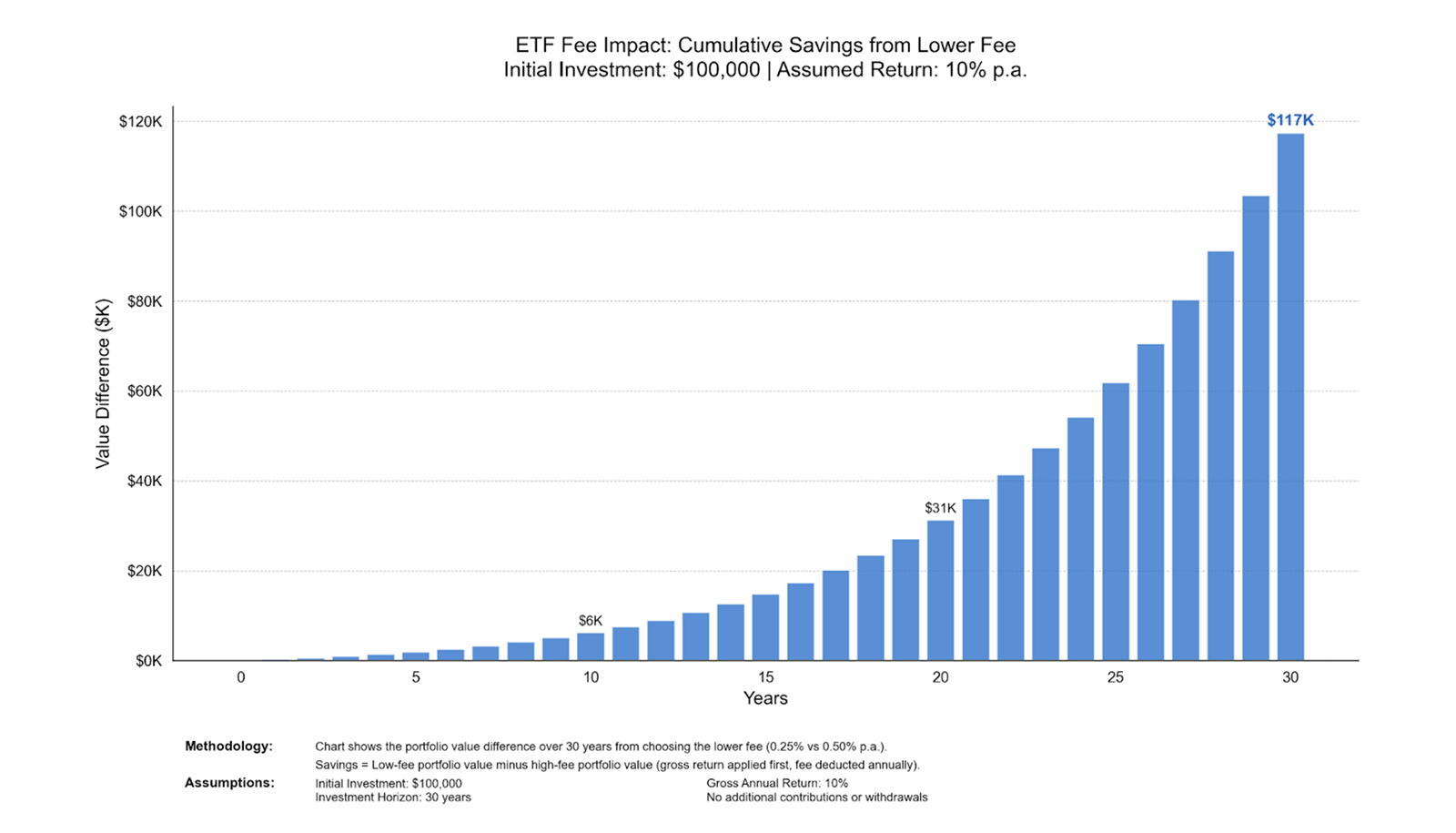

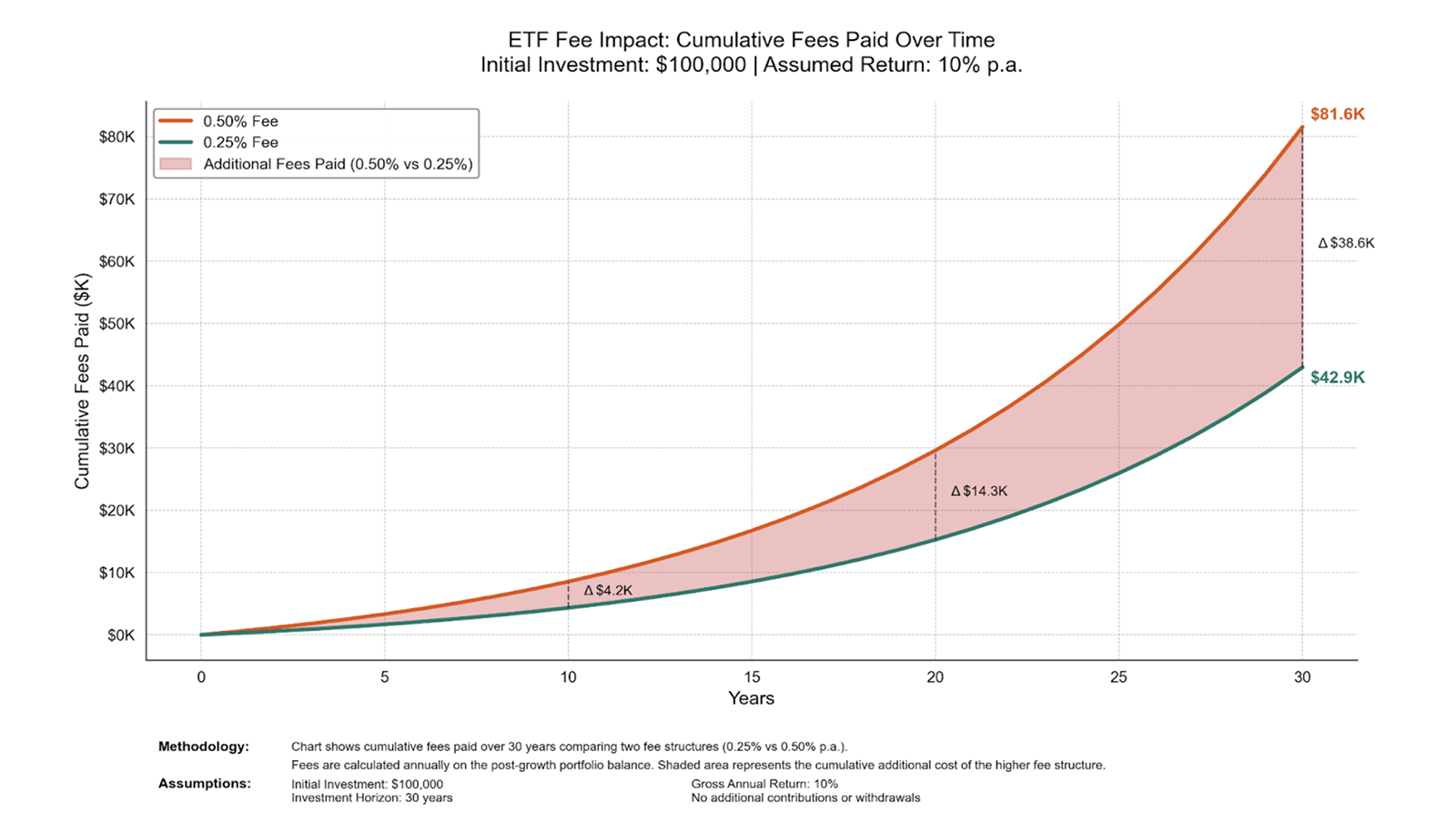

Below is an example of a $100,000 investment made in a Bitcoin ETF with a Management Fee of 0.25%, compared with the same investment amount in a Bitcoin ETF with a Management Fee of 0.50%. The time horizon for the investments is 30 years, with an assumed annual return for the Bitcoin ETFs of 10% p.a. included in the calculations and the management fees remain constant.

Over 30 years, at a hypothetical 10% annual return for the Bitcoin ETF, a difference in Management Fees of 0.25% could cost an investor $117k in final portfolio value, as shown in Figures 1 and 2.(2)

(2) Please see the example scenario data analysis in Figures 1 and 2. The ETF Fee Calculator at https://bestetfs.com.au was used to prepare this scenario.

Figure 1 (3)

(3) This figure is illustrative only and is not forecast or guaranteed.

Figure 2 (4)

(4) This figure is illustrative only and is not forecast or guaranteed.

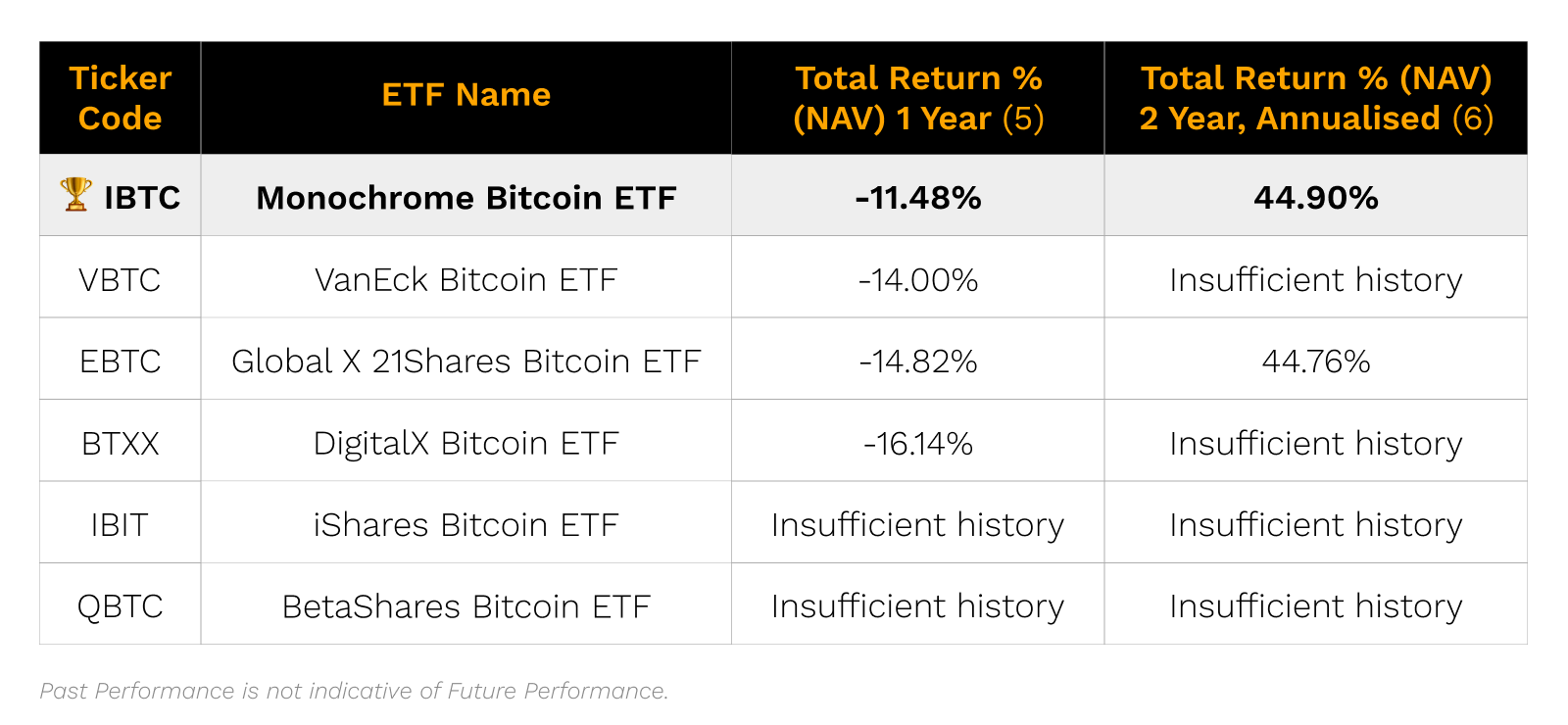

2. Total Return Performance

Total Return performance shows the complete picture of what investors actually earn from an ETF investment. It is the ultimate investor “bottom line”.

The Total Return percentages of all Australian Bitcoin ETFs are displayed below (from highest to lowest):

(5) Source: Morningstar, trailing month end returns as at 31 December 2025. https://www.morningstar.com.au/investments/security/CHIA/IBTC/performance, https://www.morningstar.com.au/investments/security/asx/VBTC/performance, https://www.morningstar.com.au/investments/security/CHIA/EBTC/performance, https://www.morningstar.com.au/investments/security/asx/BTXX/performance.

(6) Source: Morningstar, trailing month end returns as at 31 December 2025. Displayed on Livewire Markets https://www.livewiremarkets.com/fund/monochrome-bitcoin-etf; and https://www.livewiremarkets.com/fund/global-x-21shares-bitcoin-etf.

3. Tracking Difference

Tracking Difference shows how much a Bitcoin ETF's actual performance, before fees, diverges from the underlying Benchmark it is designed to track. It essentially demonstrates how efficiently the Bitcoin ETF is being operated by the Investment Manager. A Bitcoin ETF that consistently tracks close to its benchmark is operationally efficient and well-managed, optimising returns for investors.

The 1 year Tracking Difference of all Australian Bitcoin ETFs is displayed below (from lowest to highest):

![]()

(7) Data as at 31 December 2025. Sources: IBTC Fact Sheet 31 December 2025; VBTC Fact Sheet December 2025; EBTC Fact Sheet 31 December 2025; BTXX Fact Sheet December 2025. All compares are net of management fees and costs but before brokerage fees.

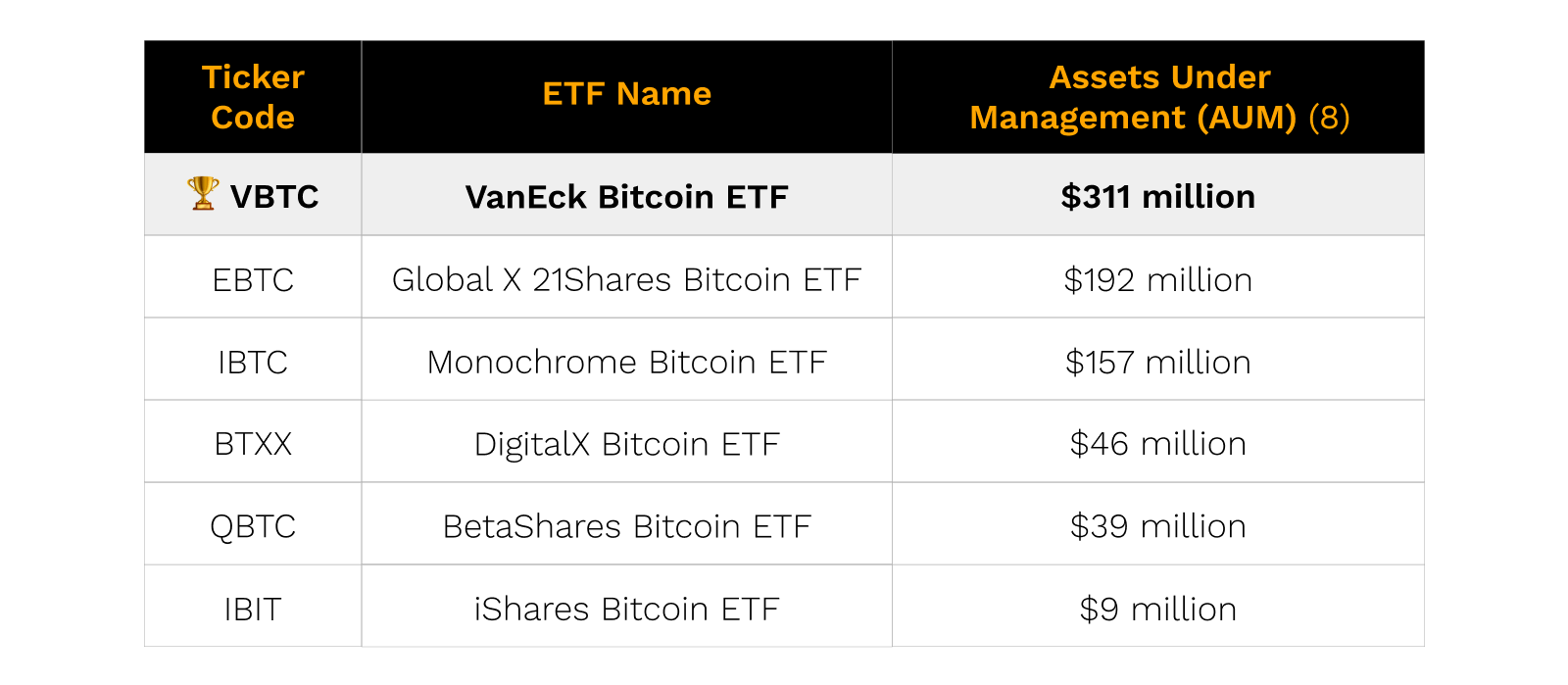

4. Size

A Bitcoin ETF’s size, as measured by Assets Under Management (AUM) is a key indicator of market adoption of the ETF, and overall investor sentiment. Bitcoin ETFs with larger AUM tend to have higher trading volume, and increased market-maker participation. That said, size isn’t everything. Smaller, specialised ETFs may offer unique features and benefits.

The AUM of all Australian Bitcoin ETFs is displayed below (from highest to lowest):

(8) As at 27 January 2026, with AUM rounded to the nearest million. Sources: https://www.vaneck.com.au/etf/alternatives/vbtc/snapshot/; https://www.globalxetfs.com.au/funds/ebtc/; https://www.monochrome.au/products/monochrome-bitcoin-etf; https://www.digitalx.com/bitcoin-etf/; https://www.betashares.com.au/fund/bitcoin-etf/; https://www.blackrock.com/au/products/346455/ishares-bitcoin-etf

Which Bitcoin ETFs deliver on these 4 metrics for investors?

So, which Bitcoin ETF deserves a spot in your portfolio? The answer depends on what metrics matter most to you.

IBTC takes the trophy (9) in three out of four key investor metrics:

- Lowest Management Fees (0.25%),

- Tightest Tracking Difference (-0.21%),

- Highest Total Returns across 1-year (-11.48%) and 2-year (44.9%) periods.

For investors focused on maximising returns, these metrics are important. Lower fees compound into significantly higher returns over time. Remember that 30-year example where a 0.25% difference in fees created $117K in additional value.

VBTC takes the size trophy (10) with $311 million in AUM, demonstrating strong market confidence and offering the liquidity benefits that come with scale.

All six Bitcoin ETFs track the same underlying asset (Bitcoin) so their returns will naturally move in tandem over time. What sets them apart long-term is how efficiently they capture Bitcoin's performance through operational excellence and cost management. Low fees, tight tracking, and consistent performance are the hallmarks of a well-managed Bitcoin ETF.

Whether you're a first-time Bitcoin investor or a seasoned Bitcoin believer, choosing a Bitcoin ETF that delivers on the metrics that matter most to you is a smart play.

Investing in Bitcoin is volatile and high risk. Investors may incur significant losses including loss of their entire investment. Suitability depends on your own investment objectives and we encourage you to consider the PDS/TMD, and to seek professional advice where appropriate.

(9) Measured as at 31 December 2025, with source data referenced.

(10) Measured as at 27 January 2026, with source data referenced.

Monochrome Asset Management Pty Ltd ABN 80 647 701 246 (Monochrome) is a Corporate Authorised Representative (CAR No. 1286428) of Vasco Trustees Ltd ABN 71 138 715 009 | AFSL 344486 (Vasco Trustees). Monochrome is the Investment Manager for the Monochrome Bitcoin ETF (IBTC) (ARSN 661 385 244). Vasco Trustees is the Responsible Entity and the issuer of interests in IBTC. The PDS and TMD for each product are available at https://monochrome.au/ and should be considered prior to investing.

This information is general in nature and does not take into account any person’s individual objectives, financial situation or needs. In deciding whether to acquire interests in IBTC and before investing, investors should read the PDS and TMD, and with the assistance of a financial adviser, consider if the investment is appropriate for their circumstances. Past performance is not indicative of future performance.

Monochrome Asset Management

Related Articles

Monochrome Partners with Galaxy Digital for Total Bitcoin Wealth Management

Monochrome Capital, a related entity of the investment manager of the Monochrome Bitcoin ETF (IBTC), today announced a strategic partnership with Galaxy Digital to deliver comprehensive Bitcoin wealth management solutions for institutional clients.

IBTC Integrated into Bitcoin-Backed Mortgages for Qualifying High-Net-Worth Investors

The Monochrome Bitcoin ETF (IBTC) has been incorporated into a Top 4 Australian bank’s residential mortgage lending framework. IBTC is now recognised alongside traditional assets such as unencumbered property and income streams when assessing high-net-worth (HNW) investors for home loans. This development connects regulated Bitcoin ETFs with private banking services, enabling Bitcoin holders to access property financing without liquidating their exposure.