Share

BRISBANE, May 16, 2022 – As the Roads to an Australian Bitcoin ETF series draws to a close, Monochrome peels back the layers of our own market, examining ‘crypto industry baskets’, regulation, and what may lie ahead for Bitcoin ETFs in Australia.

During this piece the Monochrome team will provide overview and commentary on some of the indirect products available in Australia, as well as the regulation being laid for the future of Australia’s crypto-asset investment ecosystem.

Audiences will be able to add this insight to that gleaned from the US and the futures vs spot conversation, the Canadian Bitcoin ETF race and Europe’s grapple with regulatory structures and benchmarks.

Proxy exposure through industry baskets

With increasing interest in Bitcoin and cryptocurrency more broadly, Australian markets have looked to meet investor demands via the channels available prior to spot or futures ETF availability, often utilising proxy products such as industry baskets in absence of regulated retail pathways to direct price exposure.

Our coverage picks up in April 2021, as the ASX confirmed they had begun reviewing a number of applications for cryptocurrency ETFs. The ASX avoided specifics but indicated they were spending an ‘an enormous amount of time’ on digital assets given the institutional support for them in developed markets, like the US, Canada, Europe, and the UK and the huge demand for them - for example Canada’s Purpose Bitcoin ETF amassed $1 billion in assets under management within the first month.

Six months later in October 2021, the Australian Securities and Investments Commission (ASIC) announced that Bitcoin and cryptocurrency related ETFs would be allowed to trade on licensed exchanges if all regulatory requirements were met, including compliance with Regulatory Guide 133 which stipulates minimum standards with respect to appointing custodians having at least $10 million in net tangible assets and having adequate risk management arrangements in place.

Meanwhile, product issuers were finding ways to bring cryptocurrencies to Australian listed markets through equity baskets.

On October 29th, fund manager BetaShares announced the November 2nd launch of a crypto industry basket ETF that tracked an index of companies within the crypto industry. Of the companies within that index, 85% derived revenues directly from cryptocurrency services or retained 75% of their assets in crypto holdings. The remaining 15% of the index consisted of diversified large cap companies that had at least one line of business connection with the crypto ecosystem.

Cosmos Global Digital Miners Access ETF

On November 2nd, Mawson Infrastructure Group launched their breakthrough crypto industry basket ETF on Cboe Australia (formerly branded Chi-X) via a subsidiary manager. The product, known as Cosmos Global Digital Miners Access ETF (DIGA), tracks the performance of the Global Digital Miners Index managed by Standard & Poor’s, and had the following allocation:

| Company | Top 10 Holding Weight |

|---|---|

| Marathon Digital Holdings | 15.33% |

| Riot Blockchain | 13.26% |

| Core Scientific | 13.06% |

| Galaxy Digital Holdings | 12.71% |

| Hut 8 Mining | 7.78% |

| Hive Blockchain | 6.74% |

| Canaan | 6.42% |

| Bitfarms | 6.12% |

| Argo Blockchain | 3.91% |

| Cleanspark | 3.43% |

Weighting as of 4/3/22

BetaShares Crypto Innovators ETF

A day after the DIGA launch, the BetaShares Crypto Innovators ETF (CRYP) launched and began trading on the ASX. It also tracks an index of cryptocurrency related companies. Derived from the Bitwise Crypto Industry Innovators Index, the product features several key differences in basket when compared with DIGA, one of which being the addition of Bakkt Holdings at a 3.5% weighting.

| Company | Top 10 Holding Weight |

|---|---|

| Silvergate Capital | 11.3% |

| Coinbase Global | 10.4% |

| Microstrategy | 10.4% |

| Marathon Digital Holdings | 8.6% |

| Riot Blockchain | 6.8% |

| Galaxy Digital Holdings | 4.7% |

| Voyager Digital Limited | 4% |

| Bakkt Holdings | 3.5% |

| Canaan | 3.2% |

| Hut 8 Mining | 3.1% |

Weighting as of 4/3/22

These industry baskets were the first attempts to bring crypto assets to Australian regulated markets. In doing so, product issuers attempted to bridge the gap between regulatory uncertainty for this nascent asset class and increasing consumer demand for exposure to it.

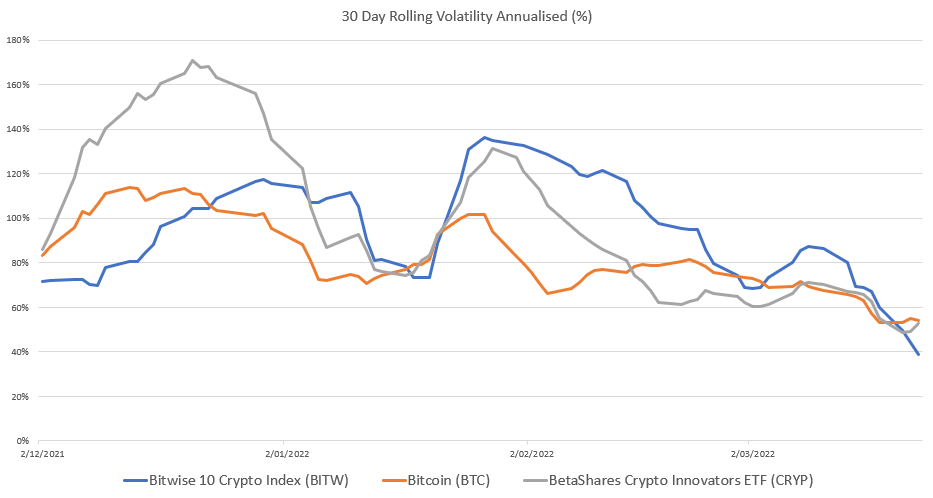

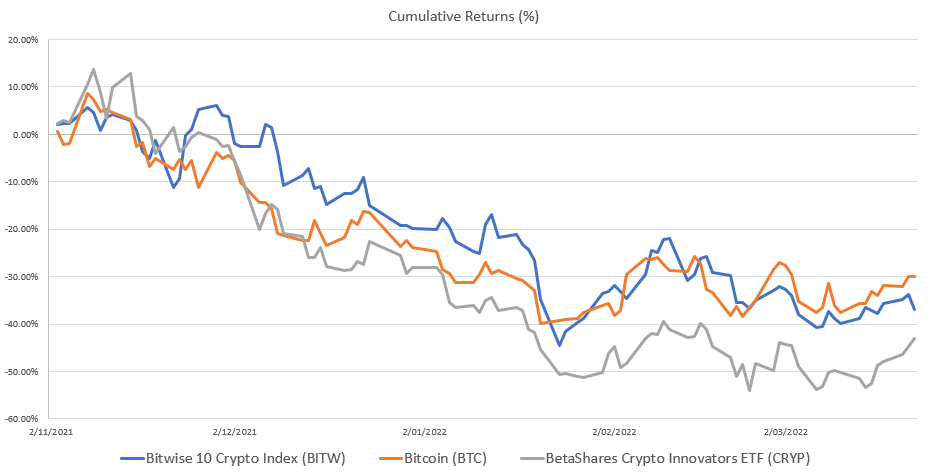

Volatility of industry baskets versus direct exposure

Marketing behind such products has often toed the line in regards to performance, volatility and risk claims, with one prominent manager offering that the ‘picks and shovels’ companies featured in crypto industry baskets were “significantly less volatile” than utilising direct exposure to cryptocurrencies.

The reality of such claims, however, would suggest the inverse.

Proof of this can be seen when comparing an Australian market ETF, the BetaShares Crypto Innovators ETF, that utilises the Bitwise Crypto Industry Innovators Index (statistics current as of 25/03/22) against a weighted index of the top 10 cryptocurrencies (via the Bitwise 10 Crypto Index) and the spot price of Bitcoin.

Using 30 day rolling volatility, the BetaShares Crypto Innovators ETF since inception holds an annualised volatility of 75.44% in comparison to 67.35% for the top 10 crypto index and 62.26% for the spot price of Bitcoin.

While European markets have UCITS-based regulatory hurdles against offering single asset crypto or Bitcoin ETFs, Australian markets do not. Crypto industry baskets provide a valuable tool for investors seeking exposure, but they should not be misconstrued as stand-ins for exposure to specific crypto-assets due to the introduction of alpha or beta management of the baskets and unanticipated caveats from doing so, despite flowery marketing assurances. Divergence in both price movement and volatility can be seen quite significantly.

As Australia waits on single crypto-asset ETF products coming to market, advisers and investors are perhaps best suited to approach all products with asbestos gloves and doing thorough due diligence on the suitability of individual products for their portfolios.

Industry baskets versus direct offerings and unanticipated risks

Despite the infancy of regulated crypto markets, the divergence between strategies aligned to industry baskets and those aligned to exposure to the actual underlying asset follows the same trend and logic found in established industries. A useful comparison to draw is with a long established store of value - gold.

Gold is a well-known example of when price divergence occurs between exposure to the commodity and exposure to the industry. A gold miner has the potential to provide higher returns than holding gold itself and vice versa. This depends on how efficiently the gold miner is operated and whether or not the gold mining market is saturated at any given time. The same can be true for companies that make the majority of their revenue from crypto related services and products.

However, gold is a well established traditional asset whereas cryptocurrencies broadly are not. The rails for crypto-asset regulation are still being built in all jurisdictions and advisers and investors need to consider whether they want exposure to the industry or the asset when building their portfolios.

For example, if one of the companies held in a crypto industry ETF basket is unable to operate in their home country due to restrictions, their business may cease to operate indefinitely or for a period of time until they relocate. Comparison of the Chinese mining migration in 2021 versus the Chinese blanket ban on holding crypto later in 2021 offers an example for this, with the Bitcoin Network presenting a more robust value proposition than many of the geographically-limited companies that service it.

Cryptocurrency exchanges and software companies that provide crypto services also face similar regulatory hurdles. These entities may be in jurisdictions with lax regulation or inadequate security standards for their products, or the inverse. Examples of this can be seen in the withdrawal of many crypto industry participants, including Binance, from the United Kingdom following tightening regulations or the BitConnect fiasco which turned out to be a Ponzi scheme and resulted in a grand jury indictment of its founder in the U.S.

The move to regulatory certainty in Australia

With understanding of US futures-based Bitcoin ETFs, Canadian spot Bitcoin ETFs and the litany of European ETPs, the question shifts quite simply towards what forms Australian Bitcoin ETFs may take.

Regulation in the crypto-asset space in Australia has been largely led by ASIC with significant contributions from Treasury and Liberal Senator, Andrew Bragg.

The earliest contribution from ASIC was Information Sheet 225 (INFO 225). Initially released in May 2019, it set out a non-exhaustive list of considerations for businesses involved in crypto-assets or considering raising funds through initial coin offerings.

In March 2021, a Senate Select Committee was put together to facilitate an inquiry into Australia as a Technology and Financial Centre, chaired by Senator Andrew Bragg. The Committee tabled its final report on 20 October 2021 (colloquially referred to as the “Bragg Report”), making 12 overarching recommendations to the Australian Government on a comprehensive regulatory regime for crypto-assets.

Key to funds was the recommendation that the Government establish a:

- custody or depository regime for digital assets with minimum standards, and

- market licensing regime for Digital Currency Exchanges, including capital adequacy, auditing and responsible person tests.

On 30 June 2021, ASIC released consultation paper CP 343 titled “Crypto-assets as underlying assets for ETPs and other investment products”. Among other things, the consultation paper called for submissions on an appropriate licensing regime, custody and risk management for crypto assets within regulated products. It also sought submissions for on market regulated products holding crypto-assets, specifically on which crypto-assets were suitable for on-market products, and robust and transparent price discovery.

In response to industry submissions received to CP 343, ASIC released Report 705 (REP 705) on 29 October 2021. REP 705 implemented significant updates to INFO 225 and INFO 230 (Exchange traded products: admission guidelines).

Importantly, REP 705 provided clarification on the criteria that listed exchange operators should use to determine which crypto-assets would be considered suitable underlying assets for ETPs, namely:

- where there is a high level of institutional support and acceptance of the crypto-asset being used for investment purposes;

- reputable and experienced service providers (including custodians, fund administrators, market makers and index providers) are available and willing to support ETPs that invest in, or provide exposure to, the crypto-asset;

- there is a mature spot market for the crypto-asset;

- there is a regulated futures market for trading derivatives linked to the crypto-asset; and

- robust and transparent pricing mechanisms for the crypto-asset are available, both throughout the trading day and to strike a NAV price.

On 21 March 2022, Treasury released its Consultation Paper titled “Crypto asset secondary service providers: Licensing and custody requirements”, seeking industry submissions regarding a proposed licensing and custody regime for crypto asset secondary service providers who are defined broadly as centralised providers who offer “crypto asset custody, storage, brokering, exchange and dealing services, or operate a market in crypto assets for retail consumers”. Submissions to the consultation closed on 27 May 2022 with Treasury yet to indicate when it will be publishing its findings.

Also announced on 21 March at Blockchain Week, held at the Australian Securities Exchange in Sydney, was a legislative proposal for a Digital Services Act which would operate separately from the Corporations Act 2001 (Cth) and call for reforms to market licensing, custody, de-banking and tax, and the regulation of decentralised autonomous organisations.

On the same day, the Australian Government released its terms of reference for a review by the Board of Taxation into the appropriate policy framework for the taxation of digital assets in Australia. The review is set to be completed by 31 December 2022.

Clearly, the digital asset industry in Australia is maturing and supported by increasing regulatory certainty from the Australian Government and regulators. This support was confirmed by Senator Bragg in a paper he delivered at the APAC Blockchain Conference on March 3rd of this year. It remains to be seen what support is provided by the incoming Labor government to the regulatory rails already built for this nascent asset class to date.

Australia now has a Bitcoin ETF, where do roads lead now?

With Australia’s first Bitcoin ETF offerings now available to investors alongside industry basket products, the question turns to the products available, as well as to what may be on the horizon.

Subscribe now to be amongst the first to read more insights from Monochrome, covering the product details that matter for investors looking to gain exposure via an Australian Bitcoin ETF.

The content, presentations and discussion topics covered in this material are intended for licensed financial advisers and institutional clients only and are not intended for use by retail clients. No representation, warranty or undertaking is given or made in relation to the accuracy or completeness of the information presented. Except for any liability which cannot be excluded, Monochrome, its directors, officers, employees and agents disclaim all liability for any error or inaccuracy in this material or any loss or damage suffered by any person as a consequence of relying upon it. Monochrome advises that the views expressed in this material are not necessarily those of Monochrome or of any organisation Monochrome is associated with. Monochrome does not purport to provide legal or other expert advice in this material and if any such advice is required, you should obtain the services of a suitably qualified professional.

Related Articles

Monochrome Partners with Galaxy Digital for Total Bitcoin Wealth Management

Monochrome Capital, a related entity of the investment manager of the Monochrome Bitcoin ETF (IBTC), today announced a strategic partnership with Galaxy Digital to deliver comprehensive Bitcoin wealth management solutions for institutional clients.